ASI Mining and Epiroc breathe rare air with a productive Autonomous Haulage System. The gold standard of autonomous mining achievements is the productive AHS (Autonomous Haulage System). Even today after nearly 20 years of development and operation, productive AHS is still a club occupied by only a few vendors – notably by the big players in the game, Caterpillar and Komatsu. This is a testament to the time, perseverance and most importantly the enormous capital it takes to turn an off-highway mining truck into a robot.

Despite the small number of serious players in this space, what makes this unassuming news release about not exactly pioneering technology so special? After all, there are over 1000 large AHS trucks in production worldwide. LinkOA was developed in about the same amount of time as it took Big Yellow to build theirs and get it into production.

In March of 2020, it started with an agreement with ASI Mining to subcontract for a 77 truck retrofit conversion at Roy Hill. In January of 2023, there were 96 trucks stepping into full scale deployment. In the meantime, Epiroc increased its 23% holding to 100% and completed the buyout of ASI Mining, and rebranded its Fleet Management System to LinkOA from Mobius. Finally in 2025, Roy Hill now operates a fleet of 96 trucks, the world’s largest single fleet.

Why this particular AHS product is remarkable? Because the LinkOA system now marketed by Epiroc is completely OEM agnostic (Epiroc AB, 2025).

“Hancock Iron Ore needed an OEM-agnostic autonomous haulage solution. We listened and we built it together. It’s been an incredible journey, and I’m extremely proud of what we’ve achieved. This milestone proves that OEM-agnostic AHS is not only possible, but it’s also real and ready for the industry.” – Diederik Lugtigheid , General Manager, AHS Business

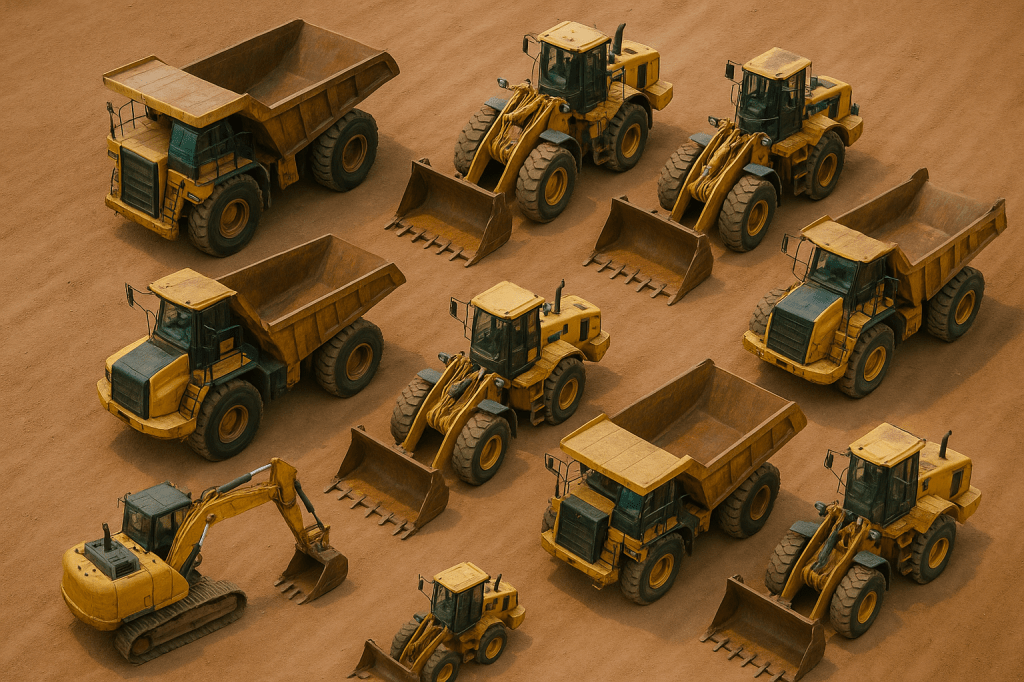

There is an extraordinary variability of equipment required for each different type of mining operation. This diversity is necessitated by factors like volume, material type, geology, distance, topography, and so and so forth – literally no two mines are the same. The opportunities this presents for the mining industry, with its eclectic mix of equipment types and sizes, is significant and potentially game changing, particularly when it comes to safety.

Previously for an existing mining operation to access the safety and productivity benefits of an autonomous haulage fleet meant becoming largely beholden to a few OEMs with a homogenous haul fleet. With the haul fleet making up the larger proportion of the overall fleet, replacing this can mean new trucks and that means capital constraints. The result is mine operators can have different diggers, loaders, push tools and potentially a mixed haul truck fleet and still strive to be autonomous.

The defining statistic for autonomous mining is no fatalities or significant injuries due to the use of autonomous mining equipment. The same can’t be said of staffed operations. With over 10 Bn tons of material moved globally, this means there are people who are going home to their families alive today because of autonomous mining.

Take for example an equivalent operation to the KCGM Super Pit, a famously long-running mine with a mix of aging fleet and OEMs. Employing an agnostic AHS system could mean embracing safer and more productive mining practices, without the need to dedicate large sums of capital to fleet replacement. Of course, this is just the asset challenges that can be solved. But in the universe of forces that affect a mining operation, having the option to reduce capital and simplify technology change is increasingly becoming a significant opportunity for risk reduction.

There are of course exceptions, and generally the age, condition and level of technology supplied with each truck and HME asset are major considerations. Assessing the viability of a shift to agnostic autonomy should not be taken lightly, and probably presents a greater level of complexity and therefore risk. Unfortunately, that antique loader is probably destined for the great hardstand in the sky if you choose the path of autonomous operations. Some in the operation will see that as a blessing! Choosing the right implementation partner and project team to mitigate this risk is already a non-negotiable for any shift to autonomous operations.

ASI mining and Epiroc are members of an exclusive club that is becoming less exclusive by the day. Ambitious players like XCMG, Eacon, Fortescue Zero, Hexagon, Scania, Pronto AI, SafeAI are all rapidly approaching the same level of maturity for their target sector.

⚠️ Opinion Disclaimer

The views and interpretations expressed in this document are based on publicly available information and industry analysis. They represent the author’s professional opinion and are not intended as financial, investment, or operational advice. While every effort has been made to ensure accuracy, no guarantee is provided regarding the completeness or reliability of the information presented. Readers should conduct their own due diligence and consult appropriate experts before making any decisions based on this content.

Leave a comment